Resources Reining in ESG Data Chaos for Value Chain Transparency

Reining in ESG Data Chaos for Value Chain Transparency

Article

Many people find ESG data sourcing and extraction to be extremely taxing. Identifying the relevant data and adapting it appropriately can feel chaotic.

Only ESG solutions that connect all the dots, offer one source of truth and produce consistent reporting metrics can bring order to the ESG data collection, calculating and communication chaos.

There’s no shortage of data available, but knowing what to look for, how to source it, cleanse it into readable formats and report on the relevant information is a global challenge in any industry. Propelled by the race to net zero, now businesses are under the microscope on their ESG progress. The data is there—somewhere—and stakeholders are likely to want to see tighter ESG targets, better reports and significant improvements across their

value chains.

Whether you have a dedicated ESG department or are a lone sustainability officer, being able to align your ESG data sources to business objectives and report on performance is crucial. Let’s break down the obstacles that can get in the way and look at best-practice solutions.

ESG Data Challenges

-

- Sourcing data is time-consuming and hard to scale

Most companies that are just starting out with their environmental, social and governance activities don’t really think ESG is all that complicated, so they jump on the bandwagon and announce their ESG targets and initiatives before knowing which performance data they’ll need to track so they can show evidence of their progress. Collecting all the relevant data in time for reporting deadlines is often an afterthought, sending internal sustainability departments and information management teams into panic mode. Chief sustainability officers and chief technology officers are regularly called upon to help with such data collection and cleansing, which is extremely time-consuming and expensive. But even data scientists, whose time costs less and who can complete the data sourcing and cleansing process faster, will often spend a lot of time on it, with recent stats finding that

80% of data scientists’ time being spent on data collection, cleansing and preparation for analysis.

Typically, larger volumes of data means you’ll need to hire more people, making it hard to scale without incurring extra costs. Unfortunately, asking for a budget increase or hiring new people is unlikely to be well received given the current economic uncertainty and the rise in inflation. Business leaders are now more cautious than before. Their willingness to spend on ESG data has been greatly reduced. A mid-2022

KPMG survey highlights that, of the “…more than 1,300 CEOs around the world…” that were surveyed, “…59% planned to ‘pause or reconsider’ their ESG efforts within six months.” That doesn’t bode well for the future of ESG data collection, processing and reporting.

-

- Fragmented, inconsistent data & regulatory standards

Data comes in different formats and is collected in different ways, making it tricky to gather and decipher. A

Deloitte survey found that one in four executives said they lacked access to essential data, and two out of three senior executives (35%) identified shoddy data as the biggest challenge when trying to gauge company performance in meeting environmental, social and governance best practices. Even if your company has a carbon emissions tool and a social impact monitoring platform, there’s no umbrella solution to tackle everything in one place and connect the dots.

Maybe you have a stellar data scientist team, and you have overcome the initial ESG reporting challenges of gaining access to the right data sources. The next hurdle is understanding what ESG metrics you need to report on.

Ernst & Young estimates there are over 600 ESG frameworks and standards around the world;

Refinitiv claims there are over 630 different ESG measures; and the

World Economic Forum (WEF) states that the metrics include 21 core and 34 expanded metrics and disclosures. Organizations with access to ESG data quickly realize that there is not one global standardized ESG metric to adhere to. The question then becomes, is your data team spending their time collecting and cleansing all this data in the right way? Will anyone even care about a particular metric or standard that you’ve chosen to adhere to?

If you’re searching, you can follow the

GRI Standards as one prominent standard to measure by. First published in 2010, the Global Reporting Institute (GRI) is an independent, international, non-governmental organization that aims to provide companies with a common language to communicate ESG impacts globally. The standards fall within three categories:

-

-

- Universal Standards, for the business activities and corporate governance of all companies

- Sector Standards, for companies in specific industries

- Topic Standards, dependent on a company’s material impacts

So, ESG standards (like GRI), policies and guidelines do, in fact, exist. But to compare these standards and have them acknowledged by all organizations, there needs to be universally accepted terminology, metrics, legal obligations and consequences. This way, every organization would be confident in, and be held accountable for, its ESG performance. There has been progress in this direction.

The EU is moving quickly toward greater accountability for ESG, with the European Commission considering policies from the

recently published report by the European Platform on Sustainable Finance (PSF) that makes suggestions related to “inadequate or non-existent corporate due diligence processes on human rights, including labor rights, bribery, taxation, and fair competition as a sign of non-compliance.” Improved ESG accountability within Europe will give teeth to policies and close loopholes, reducing non-compliance and increasing penalties. Such regulatory enforcement in the EU affects companies throughout the world that conduct business or sell products and services within European jurisdictions.

The number of countries where companies must disclose their ESG data is limited.

Convene notes that 29 countries and territories maintain some degree of mandatory ESG disclosure regulation, with many policies differing, depending on the jurisdiction. Regulatory developments in this space, however, are gaining greater traction, albeit in siloed form for now. Businesses need to stay up-to-date with this information and look for solutions to avoid the potential for risk exposure. It seems many US businesses have already begun searching, according to Deloitte’s recent

Sustainability Action Report, which states that “99 per cent of companies will probably invest in more technologies and tools related to ESG measurement and reporting during the next 12 months, which coincides with plans by U.S. regulators to require detailed disclosure on climate risks.” Companies are already actively trying to avoid the fragmentation of ESG data collection and reporting through investment in technological solutions.

If you’re having trouble collecting the relevant data for your

sustainable supply chain, we can designate professionals in the country and language of origin to collect that data… so you don’t have to.

-

- Poor visibility and increased greenwashing

You can’t share new initiatives and publish ESG reporting data without first having the right ESG data management in place to track. Poorly designed metrics and inconsistent data mean you’ll lack overall visibility into your true carbon emissions, social impacts and governance status. Much of ESG reporting is therefore skewed and based on the information companies can access and make sense of, rather than the whole picture. Accuracy also decreases substantially when you consider the other organizations within your supply chain that are facing similar problems with ESG reporting. Globally,

supply chains account for about 41 per cent of a company’s ESG impact, so the inaccuracies in ESG reporting could be enormous.

Based on an

EY report on sustainable supply chains,

Thomson Reuters stated “visibility has become one of the top priorities among supply chain leaders. Of the 525 large corporations surveyed, 58% said that increased end-to-end visibility in their supply chain was among their top two priorities in both the past two years and the upcoming two years. However, despite that desire, just 37% of supply chain leaders reported achieving supply chain visibility over the past two years, indicating a large gap between the desire for more visibility and the progress many organizations are practically achieving.” This gap between where companies want to be and where they are currently can be bridged with the right access to information, expertise and software.

Most innovation requires a solid technology investment to generate real change. You’ll need a universal system to verify the reported ESG disclosure data. Otherwise, you have to rely on public performance reports from corporations to learn about sustainability improvements. The ESG challenges for companies with many of these reports is that businesses tend to highlight more positive contributions and exclude the less favorable ones to maintain a good brand image. The metrics contributing to these reports are also often left out, with businesses making questionable and unprovable claims and remaining unaccountable.

So, it should come as no surprise that there is a rise in greenwashing in ESG performance reports and sustainability claims from organizations. This won’t last, though, as governmental bodies start to clamp down on ESG greenwashing and other forms of misleading disclosure. Recent rules have already resulted in hefty fines and investigations. A

Wired article reported that the investment unit of a BNY Mellon bank was recently fined $1.5 million by the US Securities and Exchange Commission (SEC) for misstating ESG information. The SEC launched an investigation into Goldman Sachs for misleading ESG selling. The Wired article also noted that Germany’s regulator is now investigating the DWS Group, the fund unit of Deutsche Bank AG, which the German financial regulator (BaFin) raided for ESG greenwashing. The day after the investigation launched, the DWS CEO announced that he was stepping down as a result. So indeed, as regulatory pressure mounts, the monetary and reputational risks associated with greenwashing and failure to comply to ESG standards are going to threaten an increasing number of companies that don’t act now to improve their ESG data activities.

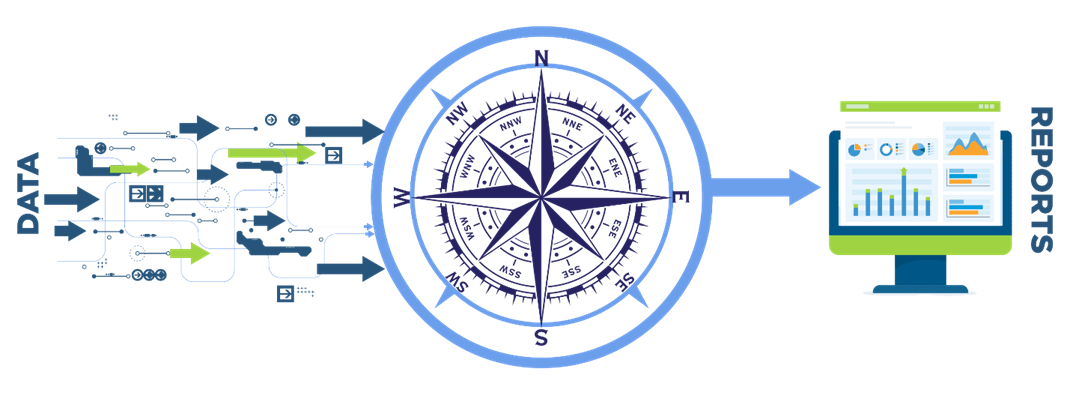

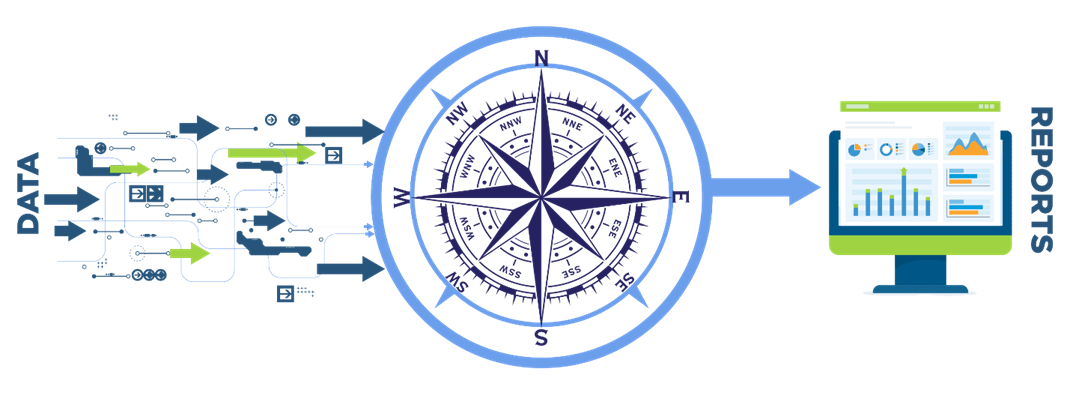

Automating the data collection, cleansing, calculating and reporting process is easy with Compass software.

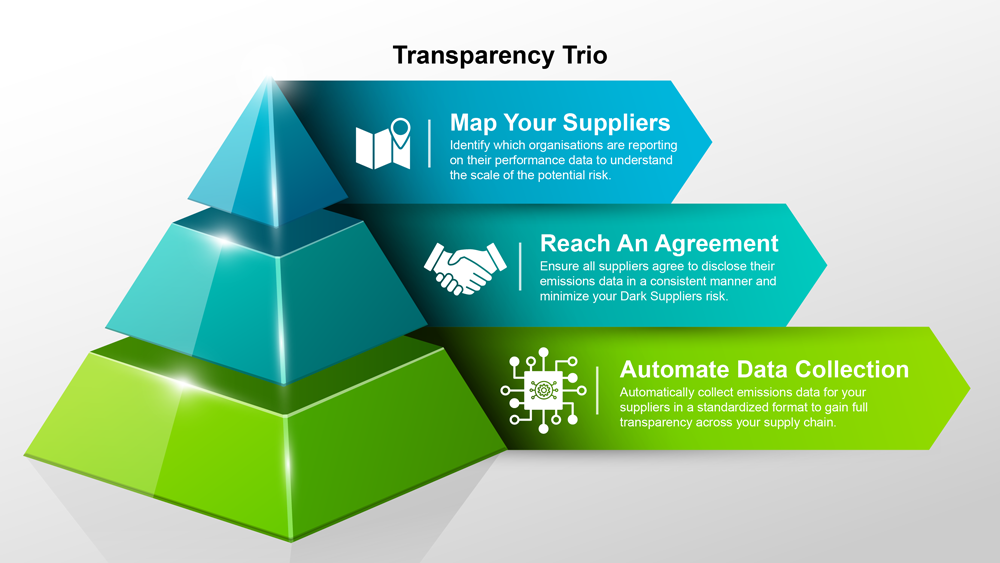

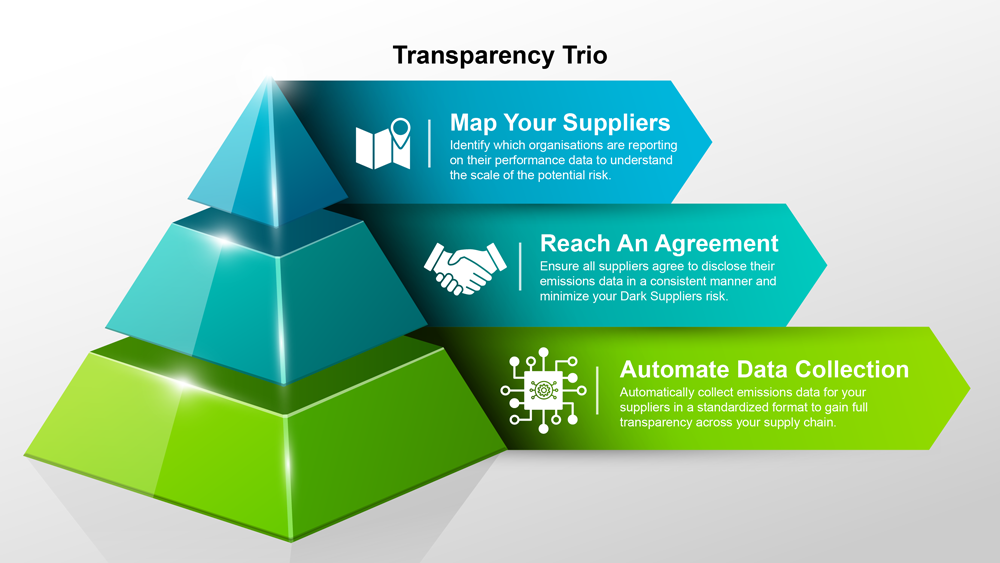

Achieving greater value chain transparency

Fortunately, there are ESG data solutions that can help you gather, calculate and report on sustainability metrics with accuracy. ADEC’s

Value Chain Transparency suite of technologies provides you and your supply chains with an end-to-end solution for fragmented, inconsistent, non-scalable, multi-system and invisible ESG data. It will allow you to align your ESG data providers and consequently automate your data collection, cleansing and reporting processes, so you can begin to trust your data and gain a more comprehensive picture of your overall ESG activities, measuring your progress against reliable metrics, complying with regulations and identifying hotspots for future improvements. And, of course, you can more easily communicate your progress to all relevant stakeholders, differentiating your business from the competition.

Check out ADEC’s Value Chain Transparency Solutions

Flemming Laursen

Flemming Laursen, Head of Sales for CleanChain, is an expert in the maximization of profit for companies through the use of ESG tools, data technology and impact sourcing. He was an entrepreneur and worked as director of sales for multiple businesses prior to joining ADEC Innovations.

If you’re having trouble collecting the relevant data for your sustainable supply chain, we can designate professionals in the country and language of origin to collect that data… so you don’t have to.

If you’re having trouble collecting the relevant data for your sustainable supply chain, we can designate professionals in the country and language of origin to collect that data… so you don’t have to.

Automating the data collection, cleansing, calculating and reporting process is easy with Compass software.

Achieving greater value chain transparency

Fortunately, there are ESG data solutions that can help you gather, calculate and report on sustainability metrics with accuracy. ADEC’s Value Chain Transparency suite of technologies provides you and your supply chains with an end-to-end solution for fragmented, inconsistent, non-scalable, multi-system and invisible ESG data. It will allow you to align your ESG data providers and consequently automate your data collection, cleansing and reporting processes, so you can begin to trust your data and gain a more comprehensive picture of your overall ESG activities, measuring your progress against reliable metrics, complying with regulations and identifying hotspots for future improvements. And, of course, you can more easily communicate your progress to all relevant stakeholders, differentiating your business from the competition.

Check out ADEC’s Value Chain Transparency Solutions

Automating the data collection, cleansing, calculating and reporting process is easy with Compass software.

Achieving greater value chain transparency

Fortunately, there are ESG data solutions that can help you gather, calculate and report on sustainability metrics with accuracy. ADEC’s Value Chain Transparency suite of technologies provides you and your supply chains with an end-to-end solution for fragmented, inconsistent, non-scalable, multi-system and invisible ESG data. It will allow you to align your ESG data providers and consequently automate your data collection, cleansing and reporting processes, so you can begin to trust your data and gain a more comprehensive picture of your overall ESG activities, measuring your progress against reliable metrics, complying with regulations and identifying hotspots for future improvements. And, of course, you can more easily communicate your progress to all relevant stakeholders, differentiating your business from the competition.

Check out ADEC’s Value Chain Transparency Solutions