But waiting to act also comes at a price, and your business might end up worse off in the long run. In this blog, you’ll uncover the true cost of waiting to report on your ESG performance data. Many countries have made it a legal requirement to report on sustainability performance data, and for those industries and jurisdictions that are currently lacking rules and regulations, it’s just a matter of time. Regardless of where you live, every business has a responsibility to improve its sustainability performance.

In a previous blog, we highlighted the key challenges with sourcing, cleaning and reporting on ESG data, breaking it down into these 3 challenges:

- Sourcing data is time-consuming and hard to scale.

- Data is often fragmented and inconsistent, as are regulatory standards.

- There is a general lack of transparency, and greenwashing is increasing, both in its volume and frequency.

To rectify these challenges, it takes a sizeable technology investment, and ideally one that can cover all of your data and reporting requirements in a single system. On the flip side, an ESG investment like this will also provide a return by preventing future business risk, improving transparency and encouraging more efficient operations. The big question that many business leaders face is what makes ESG data solutions a higher priority and better ROI than other initiatives within the business.

It’s the bottom line, literally

A business’s bottom line is its net profits—that is, what’s remaining after all of the expenses and costs of the business have been accounted for. You may not think it at first, but ESG data management is intrinsically linked with an organization’s profits. The data analyzed and reported on helps to protect the reputation of the business, find efficiencies and increase performance, all of which directly impact an organization’s bottom line. Essentially, the longer you wait to implement an ESG solution, the less potential to positively impact profits.

ESG performance data and the true cost of waiting

Maybe you’re a sustainability officer, compliance manager or environmental director, and it’s your job to ensure your ESG data sources are analyzed and reported on. You raise this with your boss, but it’s quickly met with a reason for why the timing just isn’t right. As already explained, the truth is, the timing is right, and we just need to overcome some of these initial pushbacks with some well-understood counter justifications.

Pushback #1 – “Let’s wait a few more weeks.”

The justification: If you wait another 5 weeks, that’s almost another 10% of your 2023 budget gone. You will be another 5+ weeks away from realizing the scale of the challenge and another 5 weeks behind your competitors that are investing and reporting on their ESG performance data.

More than $1 trillion was invested into ESG funds over the last two years, indicating that business leaders and investors see the value in sustainability initiatives. So why is there resistance to start investing in value chain transparency solutions straight away? It’s because ESG is seen more as a capital expense, rather than an investment that will reap a quick return. Some examples include living wages, renewable energy and social programs. While it’s true that the nature of ESG data solutions requires that you make the effort to gather the data and produce meaningful metrics, once this is completed and automated, the potential savings (monetary and operational) make it an excellent investment for an organization, providing recurring ROI, year after year.

Pushback #2 – “We don’t have the bandwidth right now.”

The justification: At some point, your business will need to overcome your ESG reporting challenges and start sourcing and cleaning ESG data for reporting. Focusing on this task may be seen as a distraction for workers in the short term, but once implemented and the metrics established, the resources required are minimal. The data analysis will also help the business make longer-term performance gains, so the efficiency benefits will far outweigh the upfront time invested.

Data scientists spend on average 80% of their time collecting, cleaning and preparing the data for analysis. Just imagine if this process was automated and how much time your data scientists would gain back. The other alternative is to task a more senior person with this request in a last-minute scramble—for example, your Chief Sustainability Officer (CSO). But when the average Chief Sustainability Officer earns a salary of between $62,780 and $208,000, depending on education and experience, it becomes a huge cost and time expense to the business to have that person do the work. If a CSO earning $100k spends 80% of their time collecting and cleaning data, that would translate into 1,664 hours per year, a total of roughly $80,000 within a year. Over the course of 3 years, with manual ESG data collection and analysis, a business could end up spending around $240,000. If the process had been automated or handled externally, the CSO would have been able to focus on strategic opportunities and maximizing profits for the business. As the years mount up, so does the cost of data collection, cleaning, etc., far outweighing the cost of implementing an ESG reporting solution now.

Pushback #3 – “It is not obligatory, so it is less of a priority.”

The justification: In several countries, ESG reporting data is mandatory, and for many more it will become mandatory soon. Therefore, your business needs to become as accountable as possible in its sustainability performance and data, or risk non-compliance, potential fines and reputational damage.

Legal obligations are not the only factors to be concerned about. You might also encounter risk to customer loyalty. PwC found that 76% of consumers will discontinue relations with companies that they perceive as treating employees, communities or the environment poorly. On top of this, there are also existential costs to not making sustainability improvements, as the Insurance company Swiss Re stated, with the “world economy set to lose up to 18% GDP from climate change if no action is taken.”

ESG reporting pays off

Numerous reports show that those companies that report on ESG performance and make positive improvements are faring better than those that don’t. For example, Bank of America Merrill Lynch found “companies with a better ESG record than their competitors had higher returns, were more likely to become ‘high-quality stocks’ and were less likely to undergo substantial price declines or go kaput.”

So, there you have it. ESG performance data isn’t a quick fix, but it can provide long-term gains. And the sooner you embed a solution, the sooner you can realize those gains. We would love to show you an end-to-end value chain transparency solution that handles all your ESG data and reporting. Reach out for more information.

If you’re having trouble collecting the relevant data for your

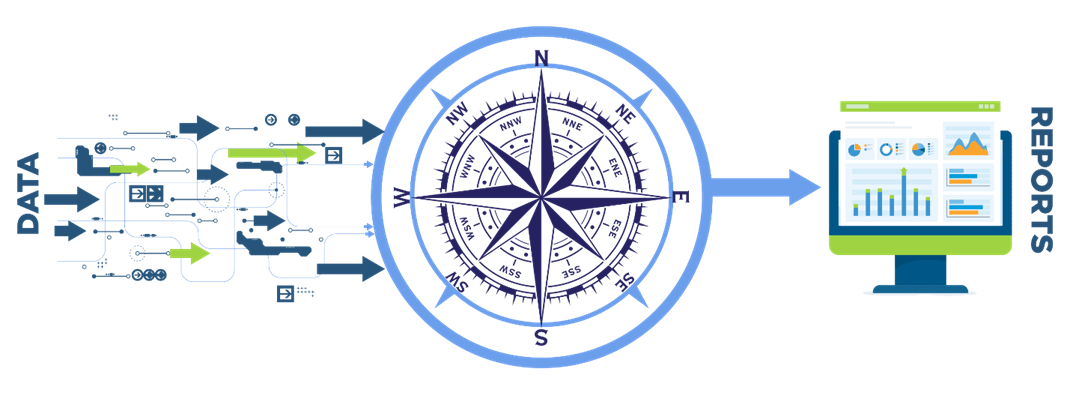

If you’re having trouble collecting the relevant data for your  Automating the data collection, cleansing, calculating and reporting process is easy with Compass software.

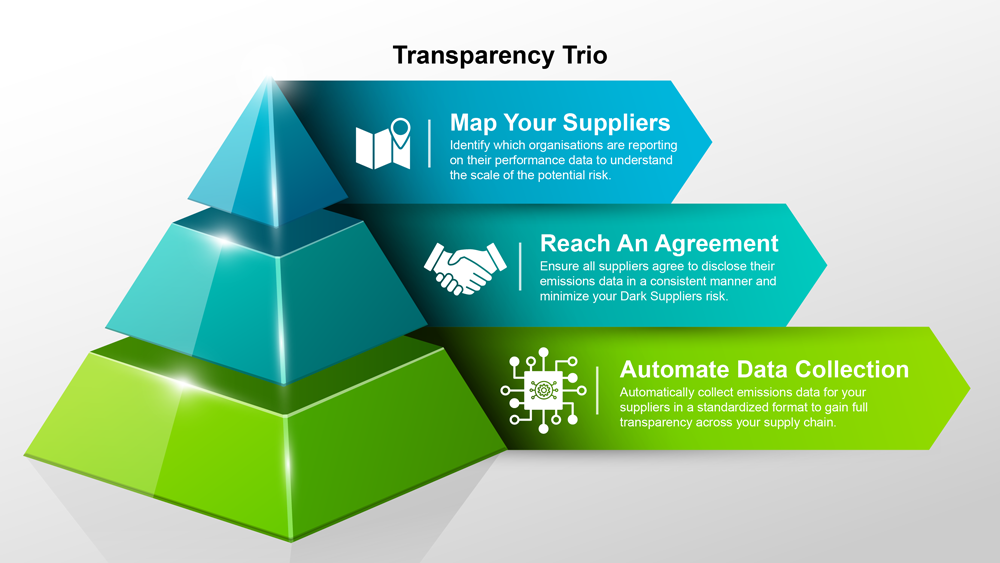

Achieving greater value chain transparency

Fortunately, there are ESG data solutions that can help you gather, calculate and report on sustainability metrics with accuracy. ADEC’s

Automating the data collection, cleansing, calculating and reporting process is easy with Compass software.

Achieving greater value chain transparency

Fortunately, there are ESG data solutions that can help you gather, calculate and report on sustainability metrics with accuracy. ADEC’s